NEXTRADE

Alternative Trading System (ATS)

We received preliminary approval for operating as an alternative trading system from the financial authorities in accordance with the Financial Investment Services and Capital Market Act (hereinafter referred to as the “Capital Market Act”) in July 2023, and are currently preparing to obtain final approval.

The Capital Market Act defines an alternative trading system as an investment trading firm or investment brokerage firm that uses a computerized system network to trade financial instruments, including listed stocks through trading process, such as competitive trading in which multiple parties participate at the same time as trading counterparties, or an entity that provides brokerage, Mediation, and agent services. (Article 8-2 ⑤ of the Capital Market Act)

Although the term ‘alternative trading system’ is still an unfamiliar concept to investors in Korea, it was introduced a long time ago and has been operating in developed countries such as the United States, Europe, and Japan under various names such as ATS (alternative trading system), MTF (multilateral trading facility), and PTS (proprietary trading system).

Overview

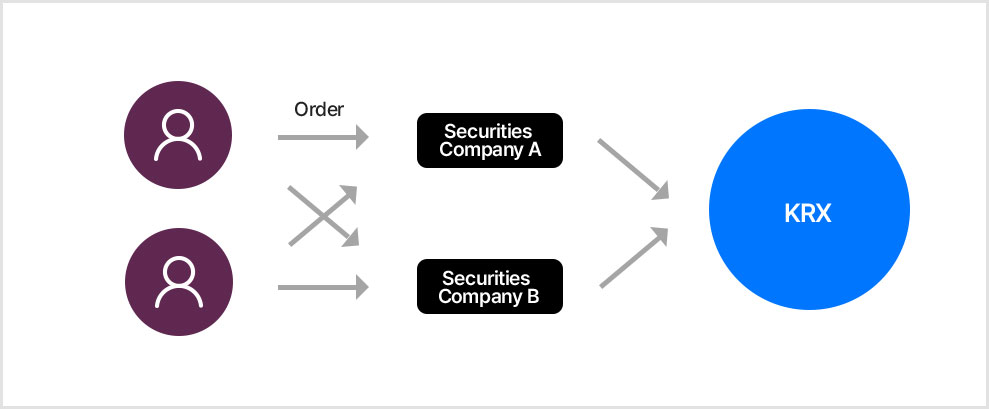

Currently, when investors want to sell or buy listed stocks to an unspecified number of people, the only way is to sell or buy them through the KOSPI or KOSDAQ market operated by the Korea Exchange (hereinafter referred to as the “KRX”).

For example, the stocks of Company A listed on the KOSPI market can be traded against an unspecified majority only on the KOSPI market, and the stocks of Company B listed on the KOSDAQ market can be traded against an unspecified number of people only on the KOSDAQ market.

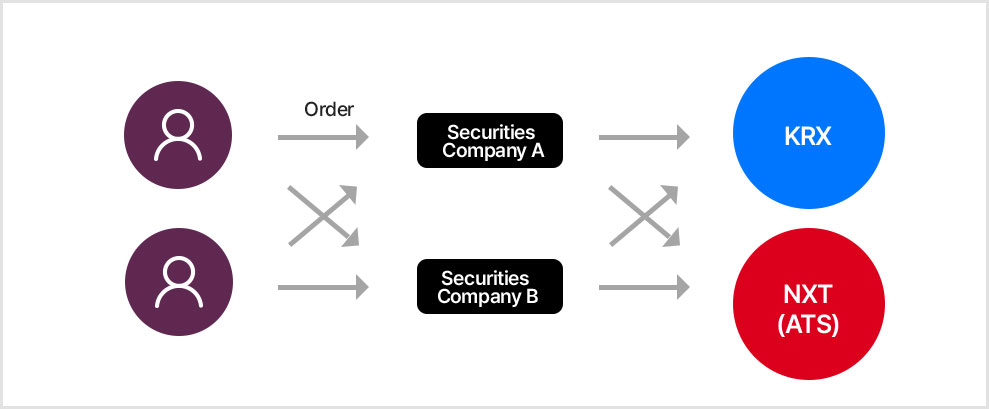

When NEXTRADE market (hereinafter referred to as the “NXT market”) opens in 2025, investors will be able to trade stocks in the NXT market in the same way as they sell or buy stocks listed on the Korea Exchange’s KOSPI or KOSDAQ Market.

In other words, the KOSPI and KOSDAQ markets operated by the Korea Exchange are currently the only trading platforms for listed stocks, but in the future, the trading platform industry will evolve into a competitive system with the Exchange market and the NXT market. The NXT market refers to a market operated by NEXTRADE as an alternative trading system to carry out trading and execution services for listed stocks.

< Changes in Stock Trading Platforms before and after NXT Market Opening >

As-Is: KRX trading market

To-Be: Multiple trading market

Trading Procedures

In order to trade listed stocks in the NXT market, investors are required to open an account with a securities company that is a trading participant in the NXT market. This is the same procedure for trading listed stocks in the KOSPI or KOSDAQ market opened by the KRX.

However, not all securities companies that can currently trade listed stocks on the Korea Exchange are required to register as trading participants in the NXT market. Therefore, investors need to first check whether the securities company with which they opened an account is a trading participant in the NXT market

Securities companies that are trading participants in the NXT market can be confirmed later on the NEXTRADE website. The trading principles and methods applied in the NXT market, such as trading quantity unit and price ceiling (±30%), are not much different from the KRX market.

However, we plan to allow investors to trade stocks even after closing of the KRX's regular market, while also introducing new order types to facilitate trading.